do pastors pay taxes on their homes

The pastor can use the tax-free housing allowance to make mortgage payments on a home and then write those payments off as well. The caveat for the self-employed is they can deduct half of the self-employment tax as a business expense.

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

There the Court explained that taxing churches would tend to expand the involvement of government by giving rise to tax valuation of church property tax liens tax foreclosures and the direct confrontations and conflicts that follow in the train of those legal processes Exempting churches by contrast would restrict the fiscal relationship between church and state thus.

. If your state law does not exempt parsonages from taxation then there is no point in the pastor transferring title to his home to the church if his only purpose is to avoid paying property taxes. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and. Circling back to the definition above.

Do pastors and priests pay taxes. You would pay the other half known as FICA taxes. If the pastor continues to live in the home it becomes in effect a church-owned parsonage.

To do this they must file a Form 4361 Application for Exemption From Self-Employment Tax for Use by Ministers Members of Religious Orders and Christian Science Practitioners by the due date of their tax return for the second year in which they had net earnings of at least 400 from performed ministerial services. Otherwise pastors are required make quarterly payments like self-employed people do. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes.

The bill is due to be passed by the House on Friday. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Pastors may voluntarily choose to ask their church to withhold their taxes by completing a W-4 form requesting that a certain amount be withheld.

Self-Employment Contributions Act SECA taxes are not directly reduced. Read customer reviews find best sellers. This rule applies if any part of your net earnings from each of the two years came from the performance of ministerial services.

However if youre a self-employed business owner you have to pay the full 153 known as SECA taxes. The years in which the earnings occurred. Clergy must pay income taxes just like everyone else.

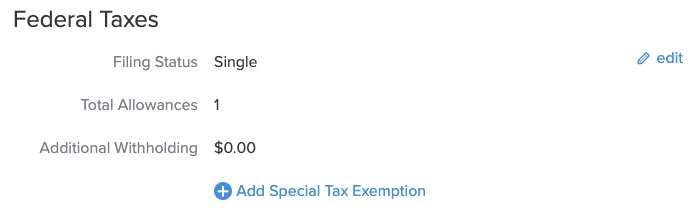

The late Rev. You must file it by the due date of your income tax return including extensions for the second tax year in which you have net earnings from self-employment of at least 400. Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks.

When a portion of a ministers gross income is received as a housing allowance federal income taxes and state taxes are directly reduced because the housing allowance reduces the ministers taxable income. The two years dont have to be consecutive. Essentially most ministers can have dual tax status.

This means that the pastors salary net profit and housing allowance are taxable by the IRS. Regardless of the employment status of a pastor Social Security and Medicare cover services performed by that pastor under the self-employment tax system. But clergy are both exempt from federal income tax withholding and considered self-employed for Social Security tax purposes.

Unfortunately the rules for clergy. In about 15 states parsonages are exempt from property taxes. 7 Vice President Kamala Harris cast the tie-breaking vote as Senate Democrats passed the 430 billion Inflation Reduction Act a climate tax and healthcare bill that includes provisions to raise corporate taxes lower prescription drug costs and reduce the federal deficit.

Therefore the minister will have to pay tax to the IRS in quarterly installments throughout the year. Since they have dual status as self-employed and as an employee of the church a churchs pastor would receive a W-2 at the end of the year to show the income theyve received. But the church should not withhold FICA payroll tax from the pastors income because pastors pay SECA or self-employment tax instead.

Kelley a leading proponent of religious freedom explained that church members are already taxed on their individual incomes so to tax them again for participation in voluntary organizations from which they derive no monetary gain would be double taxation indeed and would effectively serve to discourage them from devoting time money. If a pastor receives free housing referred to as a parsonage allowance or a housing allowance from your church that is specifically designated as such its usually exempt from income taxes. This means a church normally wont withhold income tax and never should withhold Social Security tax for clergy.

Browse discover thousands of brands.

Everything Ministers Clergy Should Know About Their Housing Allowance

Quickbooks For Houses Of Worship Understanding Pastor Payroll Youtube

The Pastor S Guide To Taxes And The Irs Ascension Cpa

15 Things Richard Hammar Wants Pastors To Know Church Law Tax

Ultimate Guide To The Housing Allowance For Pastors Reachright

How To Set The Pastor S Salary And Benefits Leaders Church

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions

Pastor Appreciation Day Are Your Love Offerings Taxable Income To Your Pastors Stanfield O Dell Tulsa Cpa Firm

The Pastor S Guide To Taxes And The Irs Ascension Cpa

How To Determine If A Pastor Is An Employee Or Self Employed For Federal Tax Purposes The Pastor S Wallet

Gusto Setup Tax Exemptions For Pastors Ministers Or Clergy Support Center

Video Q A Do Pastors Really Have To Pay 15 3 For Seca The Pastor S Wallet

Gift For Teacher College Professor Personalized Gifts Mentor Appreciation Plaque From Student Plt002

Pin On Design Inspiration Art Beautiful

Are Pastors Homes That Different Christianity Today

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazon Com Books